A few days ago, LightCounting released its latest report on the status of the optical communications industry. The agency believes that the global optical communications industry supply chain may be divided into two, and most of the manufacturing will be carried out outside of China and the United States.

The report also pointed out that China’s optical communications suppliers are beginning to transfer some of their manufacturing to other Asian countries, and continue to provide support to their customers in the United States while avoiding U.S. tariffs. Huawei and many other Chinese companies on the “Entity List” are investing heavily to develop the local supply chain of optoelectronics. An industry insider interviewed by LightCounting commented: “The whole country is working around the clock to ensure that Huawei has enough IC chips.”

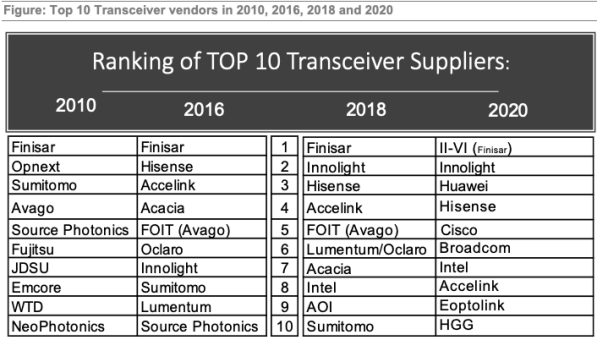

The following figure shows the changes in the TOP10 list of optical module suppliers in the past ten years. By 2020, most Japanese and American suppliers have exited the market, and the ranking of Chinese suppliers led by InnoLight Technology has improved. The list now includes Cisco, which completed the acquisition of Acacia in early 2021 and also completed the acquisition of Luxtera a few years ago. This list also includes Huawei, because LightCounting has changed its analysis strategy of excluding modules manufactured by equipment suppliers. Huawei and ZTE are currently the leading suppliers of 200G CFP2 coherent DWDM modules. ZTE is close to entering the top 10 in 2020, and it is very likely to enter the list in 2021.

LightCounting believes that Cisco and Huawei are fully capable of forming two independent supply chains: one made in China and one made in the United States.

Post time: Jul-30-2021